Discover how a commercial construction company in Orlando secured fast...

Read More

Find the best funding for your business

Get the capital you need to grow your business with our fast and flexible business loans. Apply today and see how we can help you take your business to the next level.

Get Approved for business funding as soon as Today!

By submitting this form you consent to receive messages. Message and data rates may apply. Message frequency may vary. Text STOP to opt out and HELP for help.and agree to our Privacy Policy

The Business Loan That Grows with You

At Lend on Capital, we understand that businesses are constantly evolving. That’s why we offer a variety of business loans so you can always have the funding you need to take your business to the next level, now or in the future.

Line Of Credit

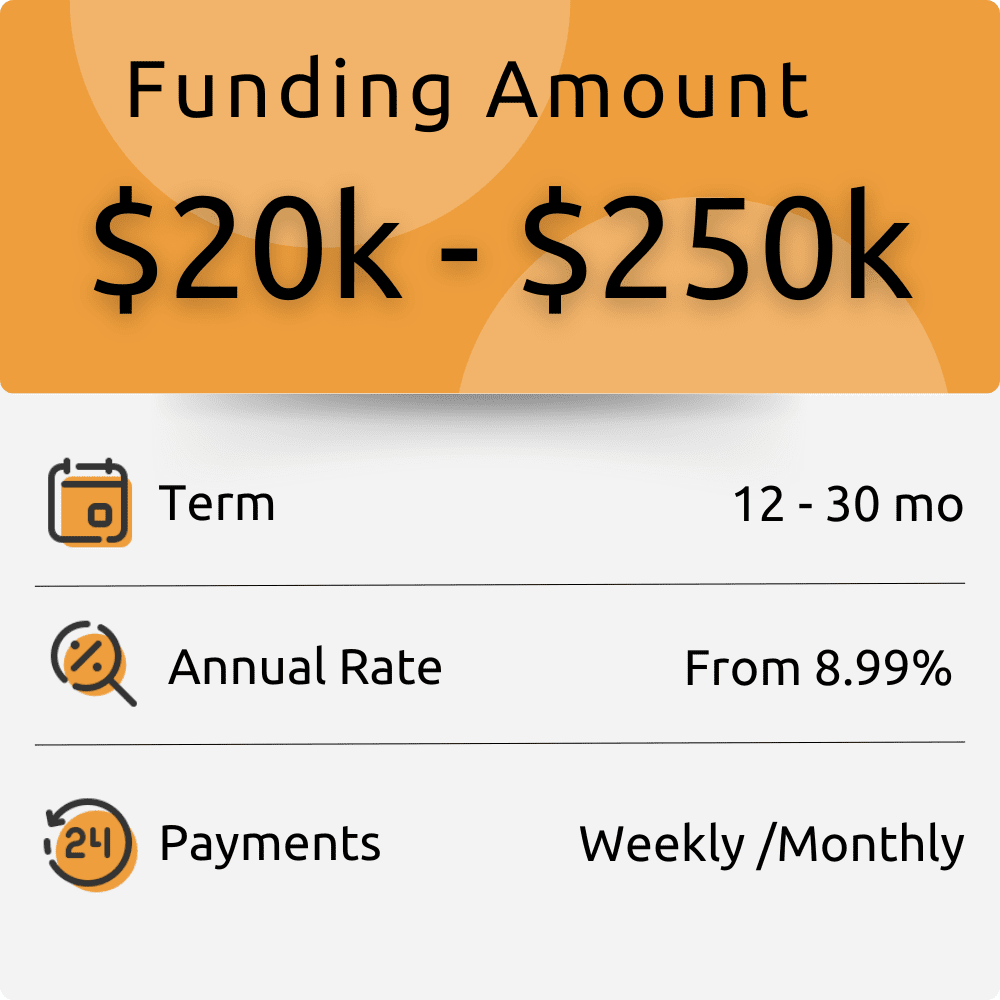

Our Business Line of Credit gives you flexible access to funds whenever you need them. You only pay interest on the amount you use. With funding from $50,000 to $250,000, competitive annual rates starting at 8.99%, and terms ranging from 12 to 30 months, you stay in control with predictable weekly or monthly payments.

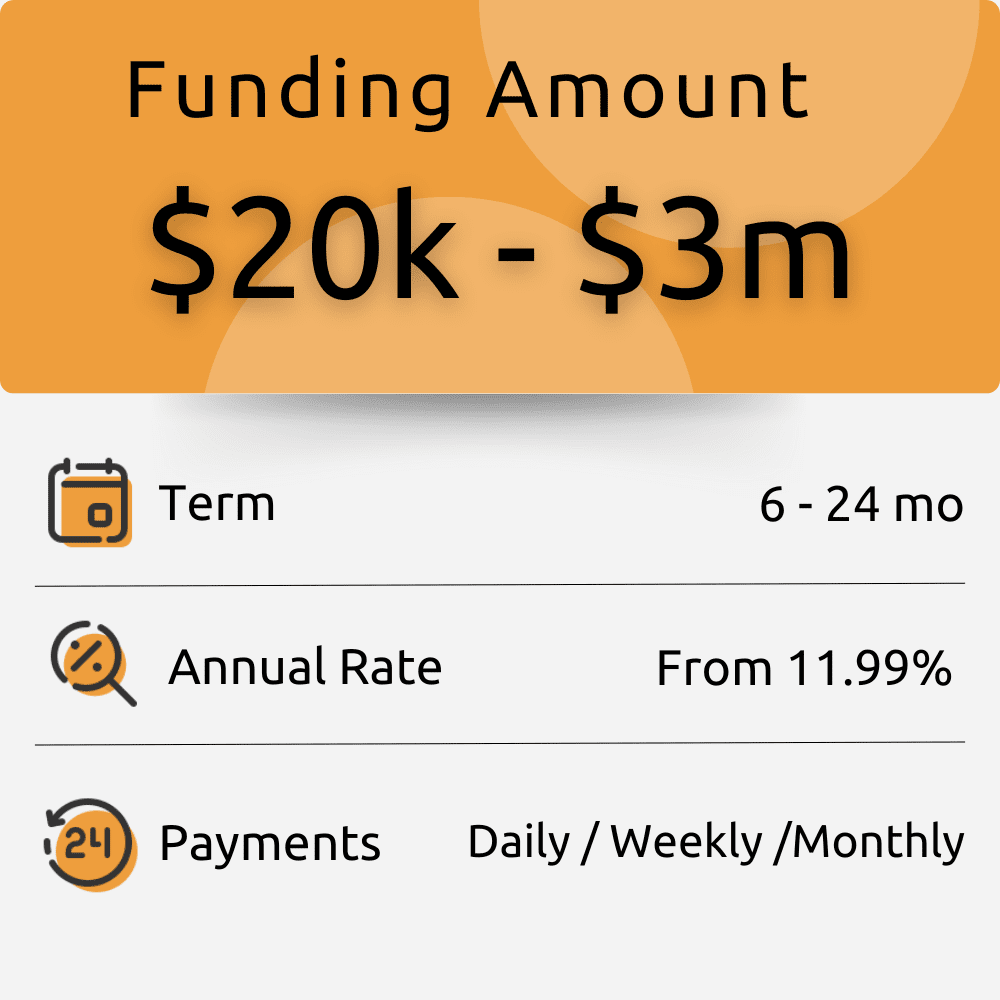

Short Term Loan

Our Short-Term Loan gives you fast access to working capital, ideal for managing expenses, covering gaps, or fueling short-term growth. Borrow between $20,000 and $1,000,000 with annual rates starting at 11.99%. Choose terms from 6 to 24 months and enjoy flexible weekly or monthly payment options that fit your cash flow.

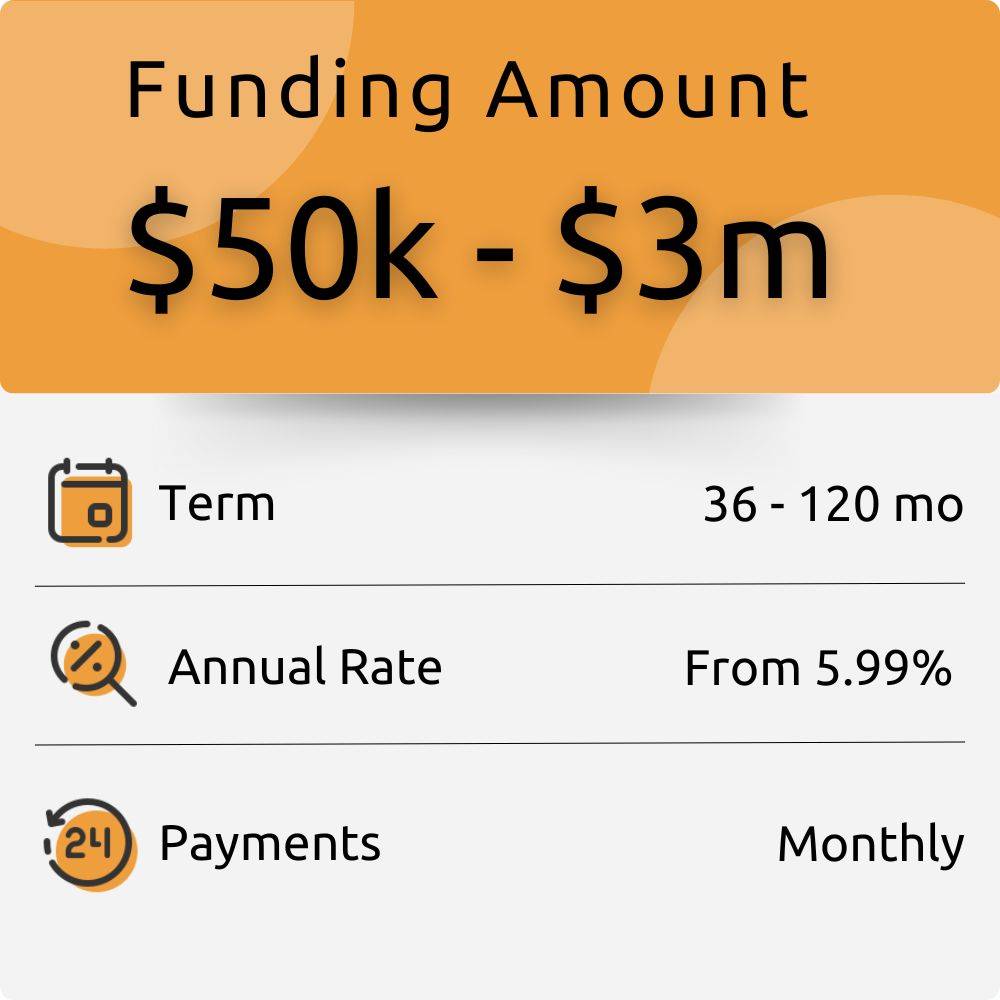

Long Term Loan

Our Long-Term Loan is designed to support major investments and sustained growth. Access funding from $50,000 to $3,000,000 with competitive annual rates starting at 6.99%. Choose repayment terms from 36 to 120 months with predictable monthly payments, giving your business the stability and breathing room it needs to scale with confidence.

Get your business Funded In Just 3 simple steps

At Lend on Capital, we've made sure that our application process is quick and easy, allowing you to get started on achieving your business goals without delay!

Choose Your Funding

Review the details of your approval and select the best funding solution for your business needs.

Get Your Loan

Complete the loan process and start using the funds to grow your business.

All you need to Qualify for a business loan*

6 +

Months in business

$20K+

In monthly revenue

500+

FICO Score

Our Testimonials

Hear From Our Clients

FAQ

Frequently asked questions

In Lend on Capital we made sure to keep the process fast & simple. Once you submit a business funding application and upload your 3 most recent bank statements our team will process the information and will provide you an offer within a few hours.

During the application process, we always do a “soft” credit pull, which doesn’t impact your personal credit.

For some applicants, at rare cases, we might preform a “hard” credit pull after you got approved and indicated that you are interested in taking the proposed funding.

- Minimum of 6 Months in business

- $200,000 in business annual revenue (This might change according to changes in the market)

- Business owner’s minimum personal credit score of 500

- No recent / current business loan defaults or judgments

- No active bankruptcies

The repayment term depends on the tier to which you got approved for. We offer 4 different repayment structures:

- Daily Payments (5 payments per week)

- Weekly Payments

- Bi-Weekly Payments (Every 2 weeks)

- Monthly payments

The payment will be drawn from your main business operating account via ACH based on the terms agreed in the funding agreement.

- Line of Credit between $30,000 to $250,000, and 6 months to 30 months term.

- Short-Term Funding between $10,000 to $3,000,000, and 3 months to 30 months term.

- Business Term Loan between $50,000 to $250,000, and 60 months to 120 months term.

- Equipment Financing between $10,000 to $3,000,000, and 6 months to 72 months term.

Our online funding application takes minutes to complete, and we require only 3 months of your most recent bank statements.

You can apply online or over the phone by calling (844) 902-3080

Blogs & Articles

Small Business Loans For Restaurant Owners

Small Business Loans for Restaurant Owners: How to Get the...

Read More